Auto

With Tokio Marine Highland’s Collateral Protection Insurance (CPI), you have a win-win solution that secures your consumer loan portfolio by protecting your interests and helping your customers protect theirs. When your customer’s insurance cancels, lapses or expires for whatever reason, you can instantly place coverage as soon as you find out. Your interest stays secure and your customer remains protected against a potential uninsured loss or damage.

To ease the burden of managing insurance per loan, CPI is also available as Lenders Single Interest Insurance for all eligible loan collateral in your consumer loan portfolio.

Financial Strength

A wholly owned subsidiary of international insurer Tokio Marine Kiln, rated A (Excellent) by AM Best

Best-In-Class Service

Dedicated accounted services representatives for prompt support and an unrivaled customer experience

Fast Claim Support

Quick and easy claim reporting via a web-based portal and managed by our wholly owned company, Precise Adjustments

Secure Your Portfolio with Collateral Protection Insurance

With Tokio Marine Highland’s lender-placed Collateral Protection Insurance (CPI), you protect your interests by helping your borrowers protect theirs. Our CPI program provides a full range of administrative and support services that include inception-to-date insurance data capture and management, borrower notifications, exposure reporting, coverage placement, and customer service call center.

CPI is also available as Lenders Single Interest blanket insurance for all eligible loan collateral in a client’s consumer loan portfolio.

Download our product brochures to learn more.

Collateral Protection Insurance (CPI)

Lenders Single Interest (LSI)

Insurance Tracking Services

Download one of the following applications to begin securing your portfolio today.

Collateral Protection Insurance (CPI) Application

Lenders Single Interest (LSI) Program Application

Cover the GAP Between Insurance Payout and Loan Payoff

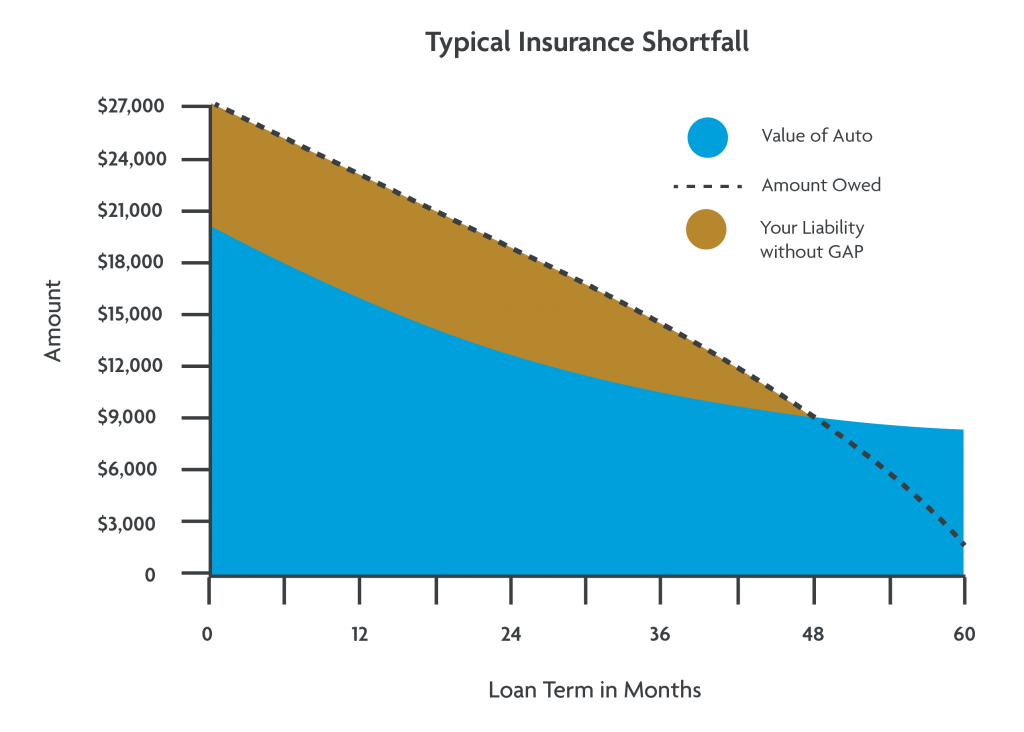

With vehicle values declining rapidly during the first few years of ownership, loan terms increasing and down payments decreasing, the loan payoff amortizes more slowly. If a vehicle is stolen, accidentally damaged beyond repair, or declared a total loss, the borrower’s insurance will only cover the depreciated or actual cash value of the vehicle. The borrower remains liable for the difference or “GAP” between the insurance settlement and loan payoff. Tokio Marine Highland’s Auto GAP product protects the lender and borrower from this deficiency.

Tokio Marine Highland’s Auto GAP Benefits

How Auto GAP protection benefits lenders:

- Reduces credit and loan losses

- Provides valuable service to borrowers

- Provides fee income opportunity

- Increases borrower satisfaction

- Eases administrative and claim filing processes

- Provides optional internet-based training

How Auto GAP protection benefits borrowers:

- Limits out-of-pocket expense

- Protects credit rating

- Helps prevent financial hardship

- Makes purchase of a replacement vehicle more affordable

- Provides peace of mind

To simplify administration, Tokio Marine Highland’s web-based GAPExpress™ solution enables a lender to price GAP enrollments, print waiver forms, track GAP sales by lending officer or loan originator, and submit GAP enrollments online.

Auto GAP Options for Added Benefits

GAP Advantage is an option that delivers an additional borrower benefit by providing a discount allowance up to $1,000 toward a replacement vehicle, as long as financing is with the same lender. GAP Advantage is not available in all states.

Download our Auto Gap Protection Application to begin working with us today.

Contact Us

Sheri Kordsmeier

Senior Vice President, National Sales, Specialty Property Division

Sheri Kordsmeier, Senior Vice President, National Sales, joined Tokio Marine Highland in 1996. Sheri’s focus is on new business development while continuing to enhance key client partnerships through proactive communication … Read more